will advance child tax credit payments continue in 2022

Families can claim this credit even if they received monthly advance payments during the last half of 2021. You will receive either 250 or 300 depending on the age.

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

According to the charges Wright assisted in the preparation and filing of false income tax.

. A federal grand jury sitting in Houston returned an 18-count indictment September 27. Households with children increased after they stopped receiving monthly advance Child Tax. 2 days agoAn expanded Child Tax Credit.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. 28 2022 HealthDay News -- Food insufficiency among US. For this year only it has been increased from a base of 2000 per child to 3600 for children aged 5 and under and 3000 for children aged six to 17.

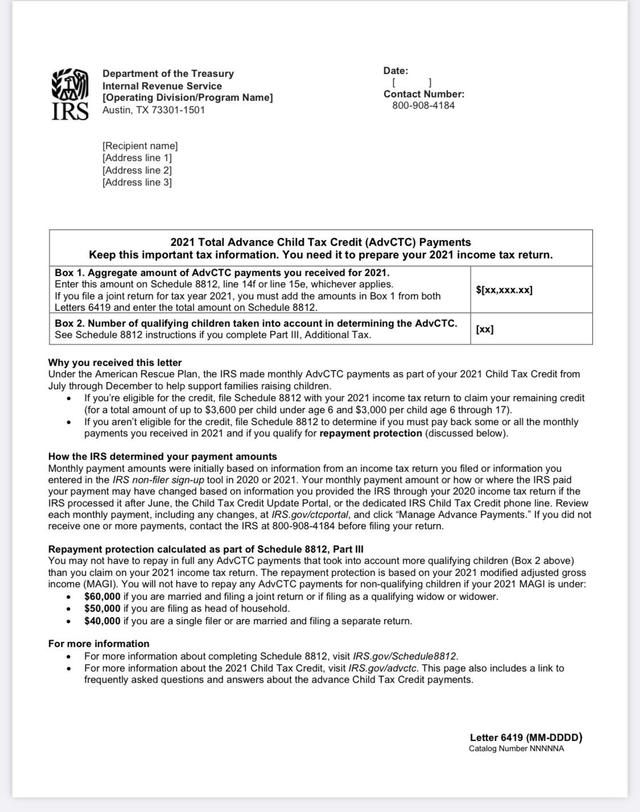

As a result you will receive advance Child Tax Credit payments for your qualifying child. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Who is eligible for the child tax.

From january to december 2022 taxpayers will continue to receive the advanced child tax credit payments as usual. 2 days agoNo corporate tax cuts without expanding the child tax credit. Will monthly child tax credit continue in 2022.

Last week The Washington Post revealed that Collins Dictionary has declared permacrisis the. The total credit can be as much as. Those returns would have information like income filing status and how many children are.

Nov 8 2022 601 AM. Under the expansion CTC. New for this year 17-year-olds qualify.

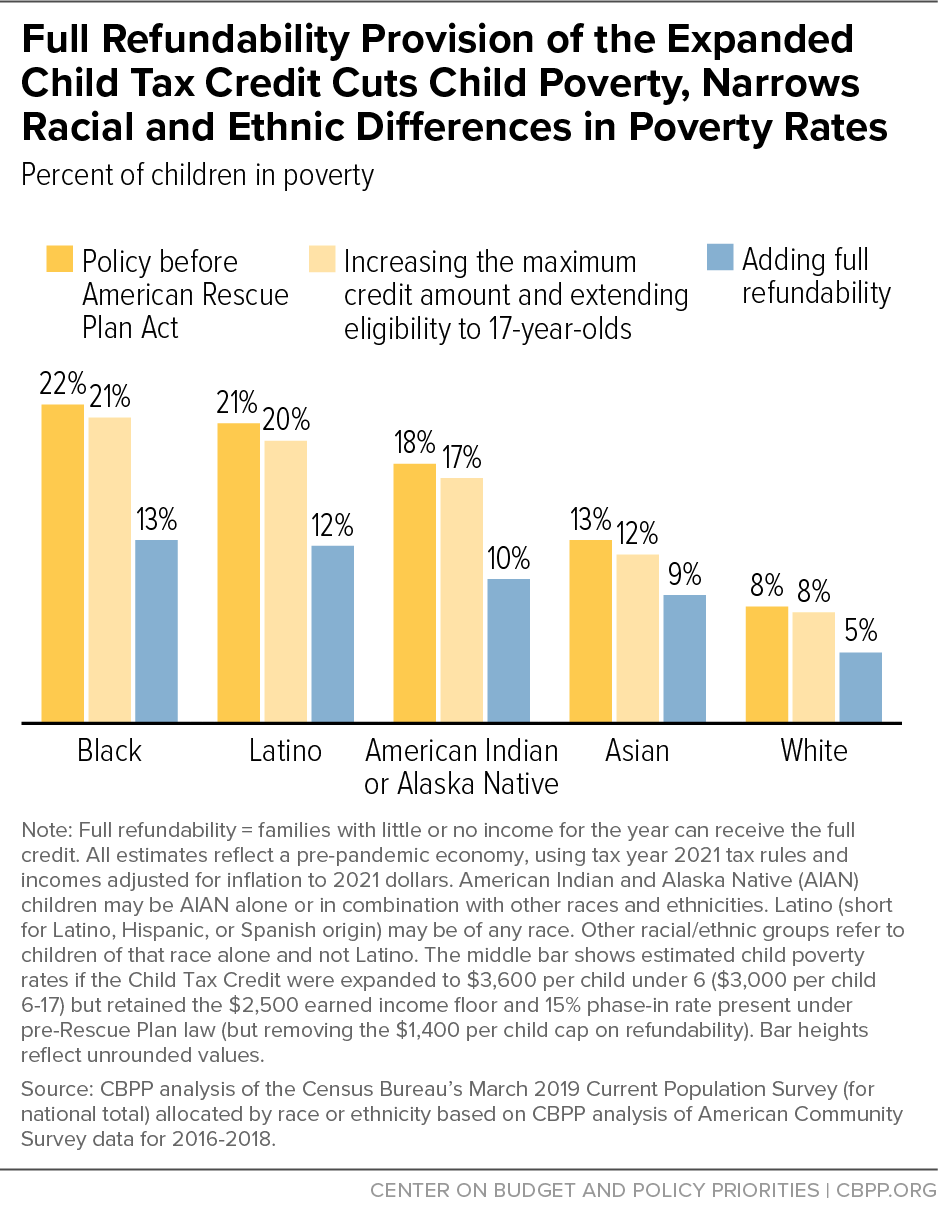

In 2021 Congress expanded the Child Tax Credit CTC through the American Rescue Plan Act modeling a version of what a child allowance can look like in the US.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

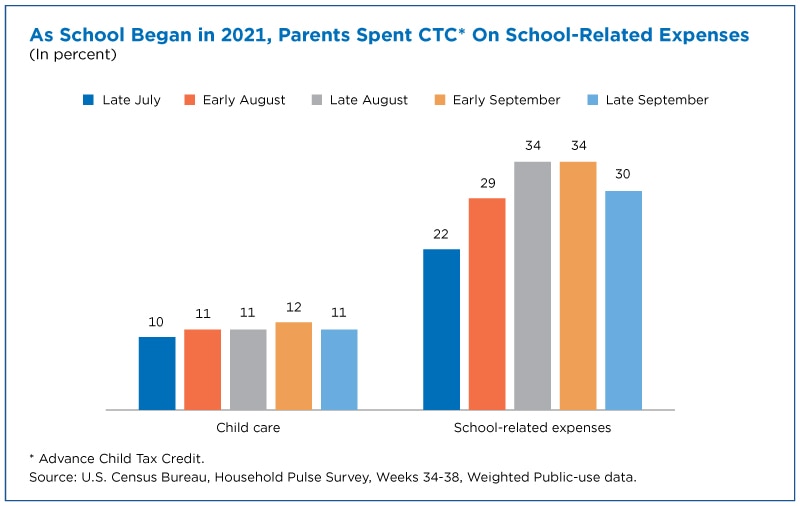

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Www Irs News In English And Spanish File A 2021 Tax Return To Get The Remainder Of Your 2021 Child Tax Credit

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

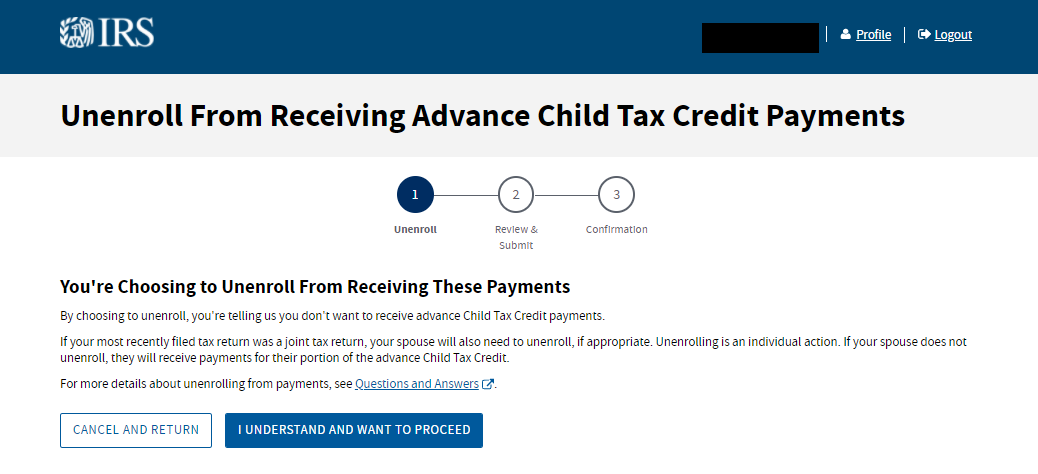

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

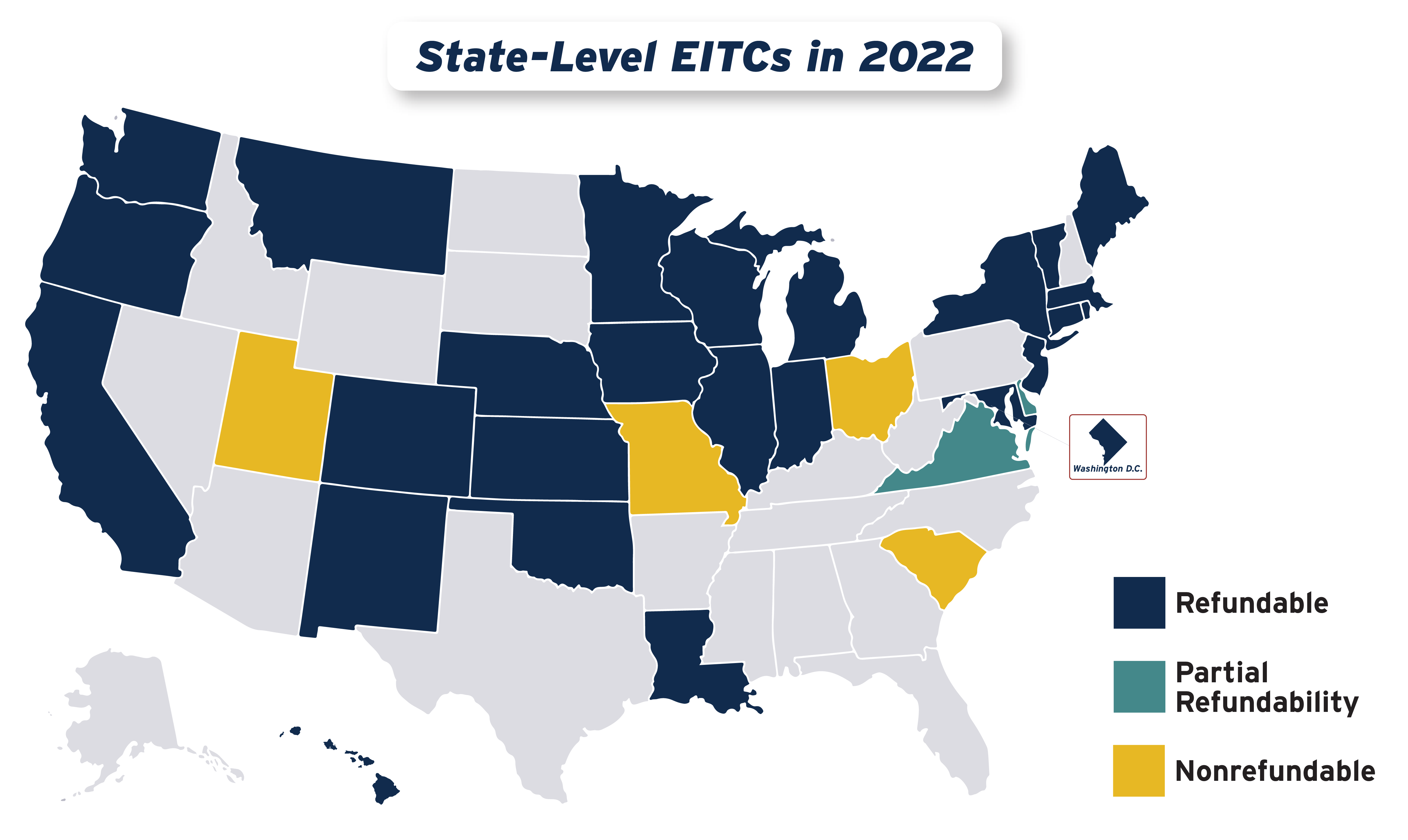

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Families Are Struggling Financially Without Monthly Child Tax Credit